Helping You Say “Yes” to Your Dreams - Faster with the Right Loan.

Flexible loans from $10,000+ for Australian citizens and permanent residents with steady income, ready to take the next step

Next Step: Complete the form to get funded quickly

How We Turn “Not Yet” Into “You’re Approved”✔️

✔ Income assessed first - not just deposit size

✔ Remove hidden issues holding approval back

✔ Government-backed options applied correctly

✔ Loans structured properly from the start

Designed for Australian citizens and permanent residents, LodgePro makes securing your first home or investment property simple and stress-free through a secure lending process and show you exactly what you can afford.

Check if You Qualify✔️

We provide loans to borrowers who meet the following conditions. If this sounds like you, you’re already on the right path.

Minimum loan amount: $10,000

Intended for longerterm borrowing only

You must be in gainful employment with a regular income. Pensioners must also have business or employment income.

You must not be in financial distress or hardship that could be worsened by the loan

You must be an Australian Citizen or Permanent Resident and able to communicate in English

Get Funded in 3 simple Steps

Quick, transparent, and designed to make borrowing effortless.

Tell Us What You Need

Start by completing a short online form. It takes less than two minutes to provide your details.

Speak with a LodgePro Mortgage Broker

Once you’ve submitted your form, one of our experienced in-house mortgage brokers will personally get in touch. We will take the time to understand your goals, your budget, plans, and what you’re really looking for, to find the right loan for you.

Review & Apply

Our broker will present tailored loan options from trusted lenders that genuinely suit your situation. Choose the best fit and complete your application securely with our expert guidance.

Why LodgePro Is the Smarter Lending Choice - And Why You’ll Agree?

Loans Designed Around You

We don’t believe in one-size-fits-all lending. We take the time to understand your goals and match you with lenders who genuinely fit your needs.

Fast Approvals, Zero Headaches

Apply online in minutes and skip the chaos of paperwork and long queues. We keep things smooth so you can focus on what matters.

Honest Rates. No Hidden Surprises.

Everything is upfront- rates, fees, terms. You’ll always know exactly where you stand, with total transparency from day one.

Your Personal Lending Team

Our expert finance specialists stay by your side from application to approval, making sure every step feels clear, simple, and supported.

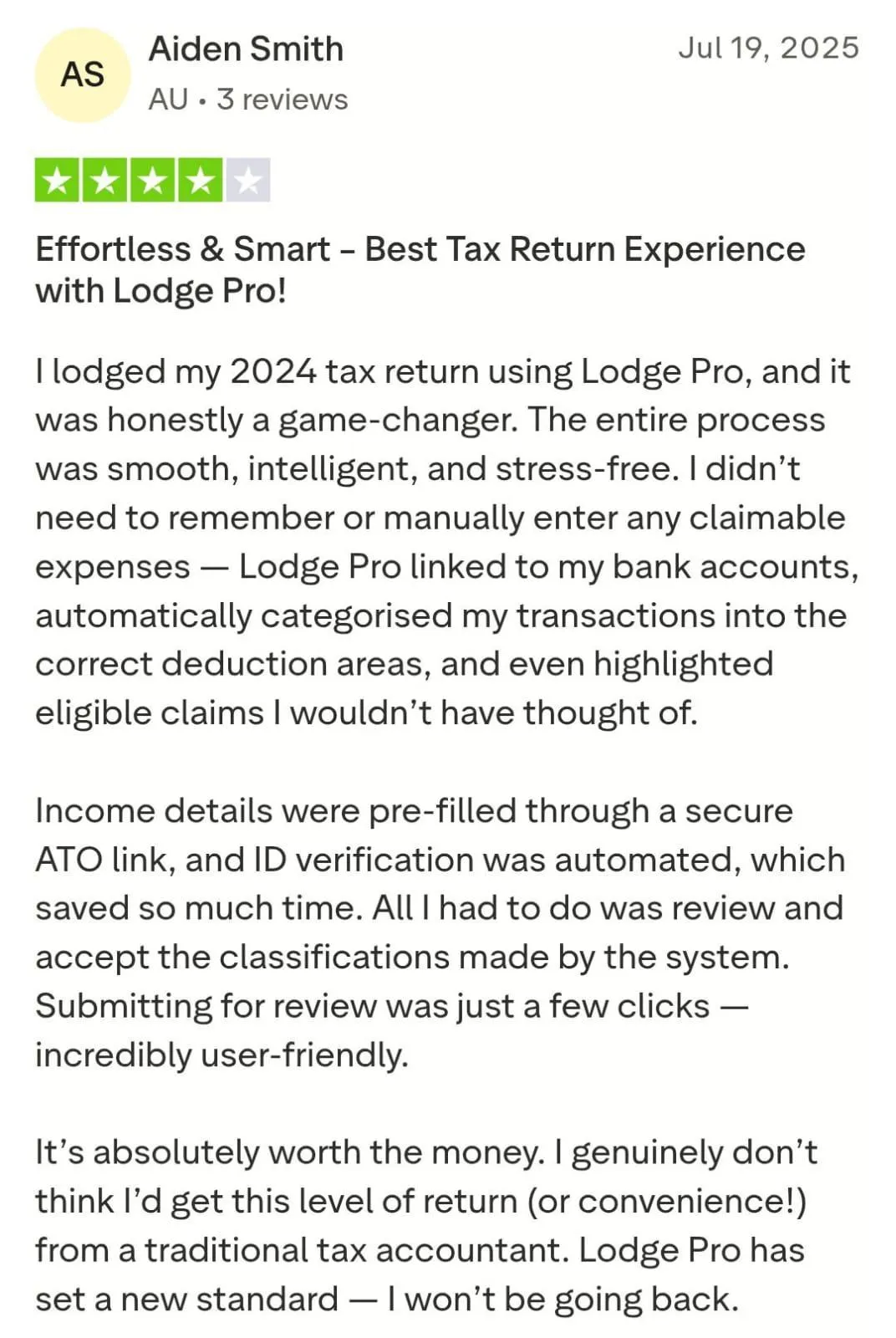

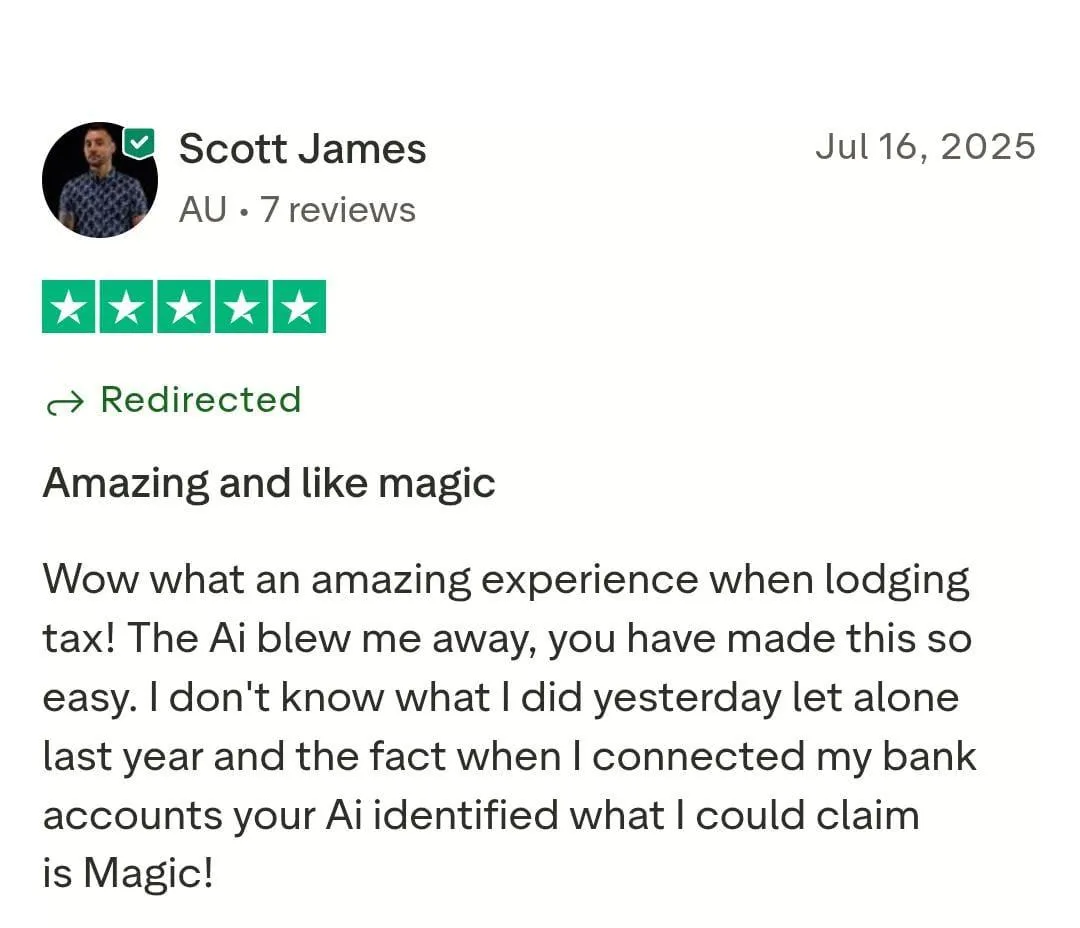

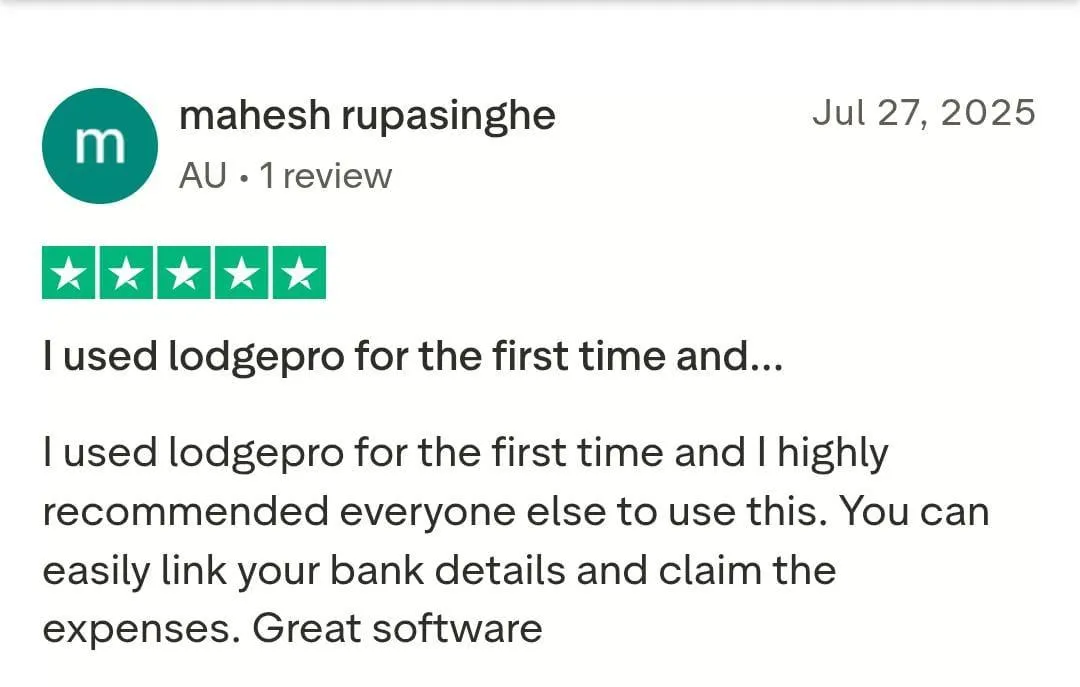

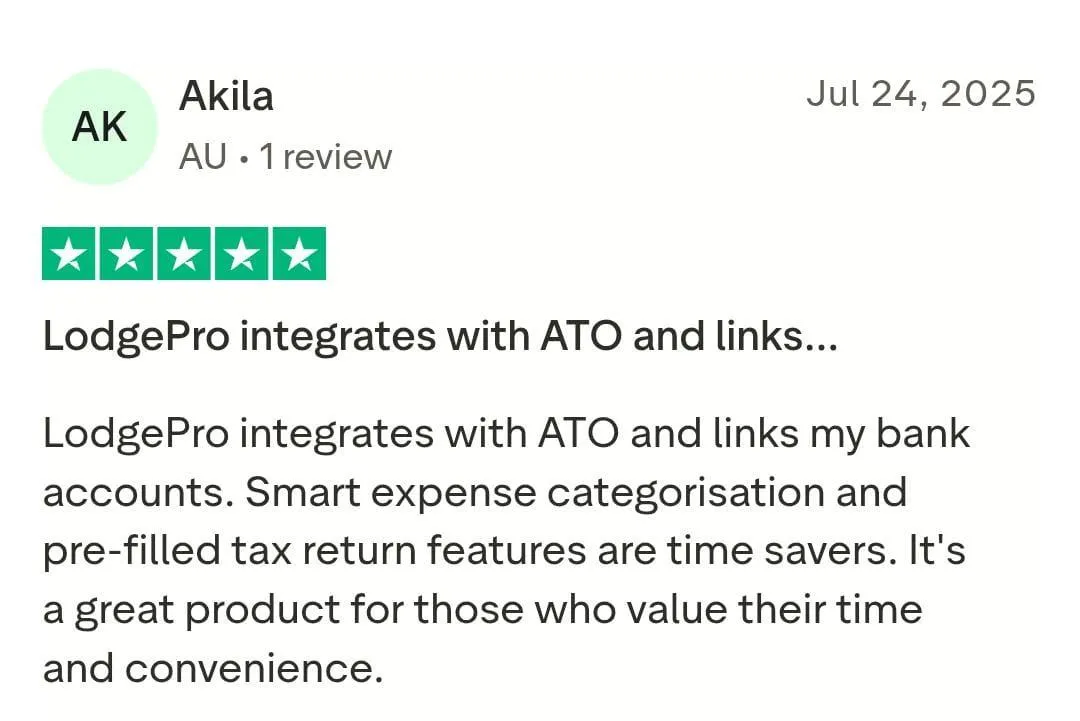

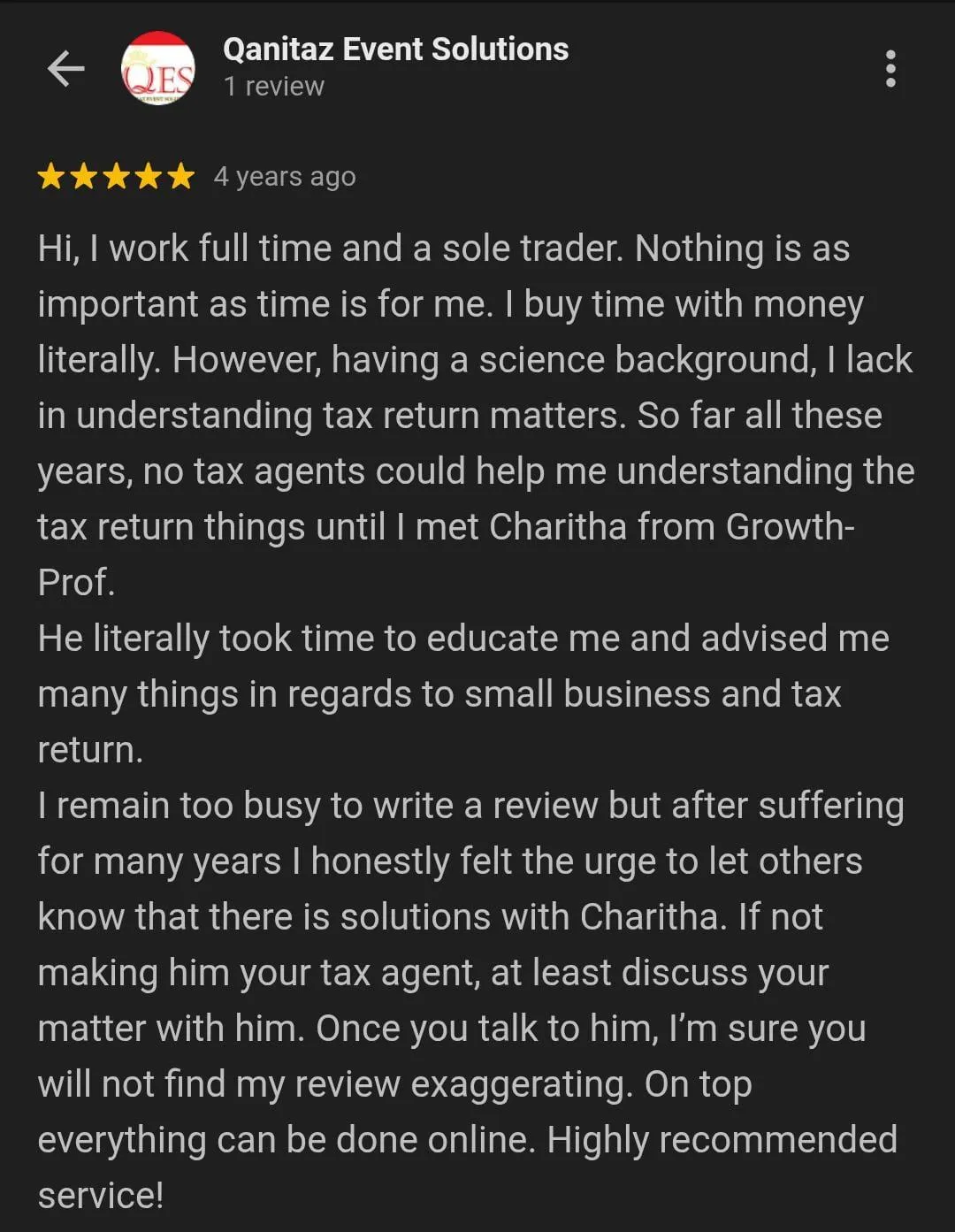

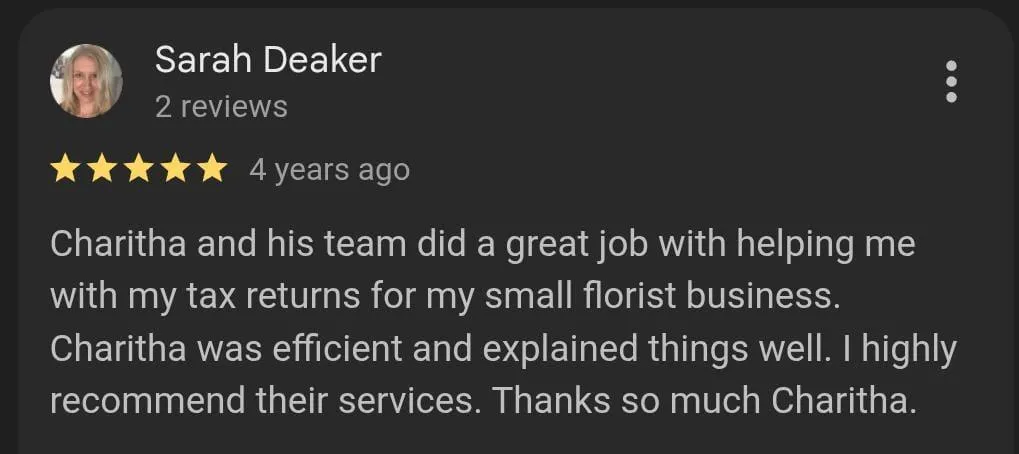

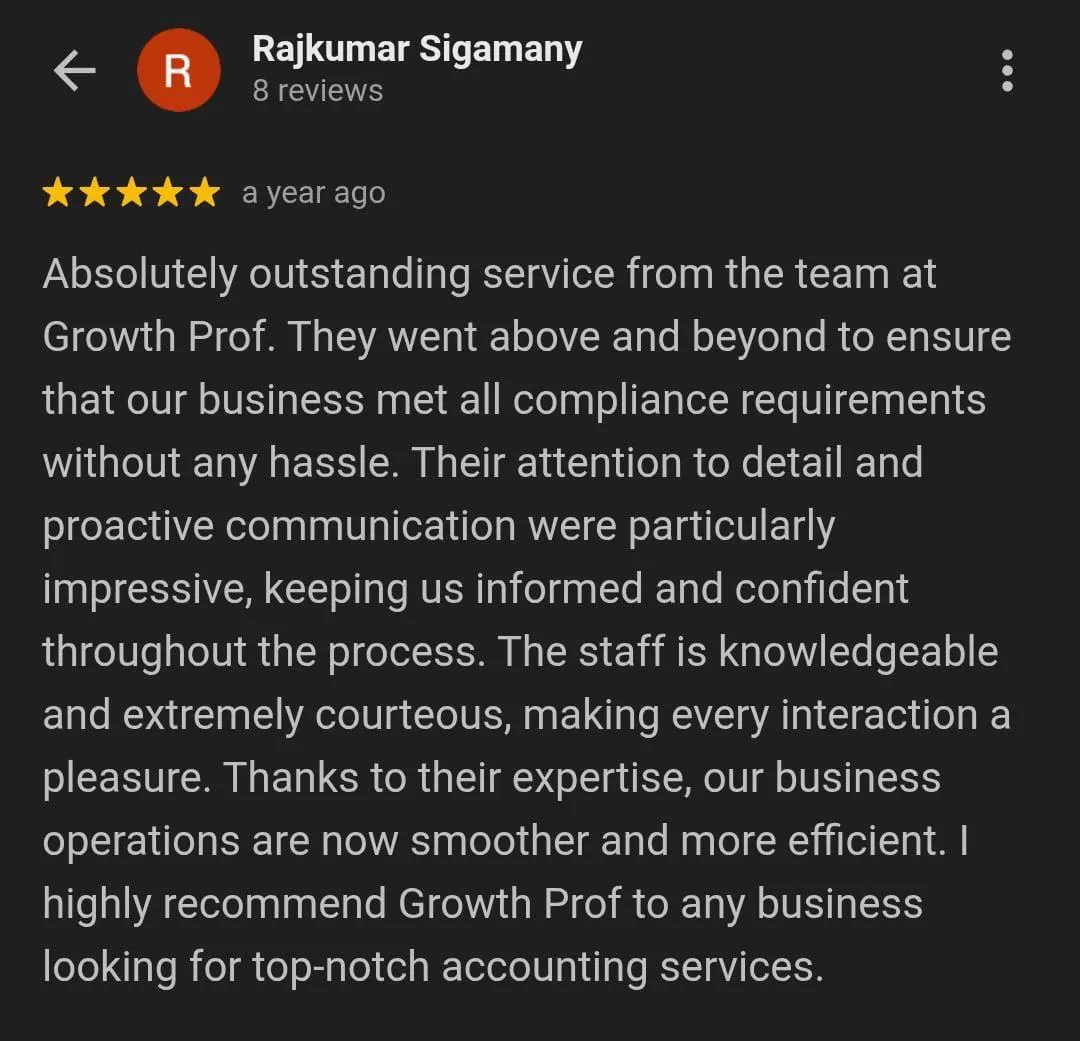

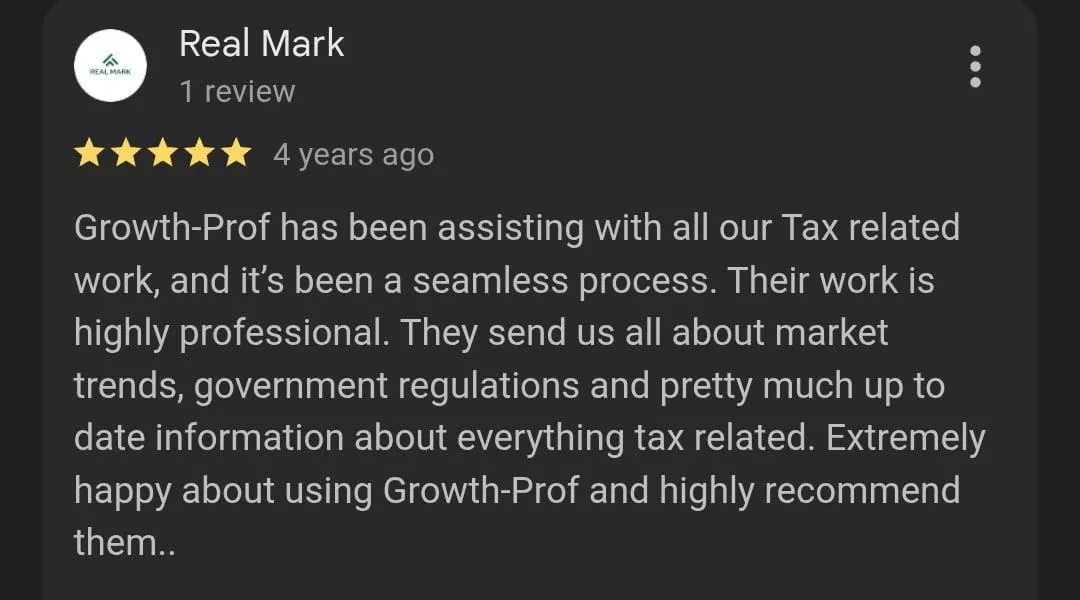

Clients Who Started Where You Are Now

Why LodgePro Is the Smarter Lending Choice - And Why You’ll Agree

Personalised Loan Matching

Our mortgage brokers assess your needs and connect you with lenders offering competitive rates and terms that suit your goals.

Fast & Simple Process

Apply online in minutes and skip the chaos of paperwork and long queues. We keep things smooth so you can focus on what matters.

Honest Rates. No Hidden Surprises.

Everything is upfront- rates, fees, terms. You’ll always know exactly where you stand, with total transparency from day one.

Your Personal Lending Team

Our expert finance specialists stay by your side from application to approval, making sure every step feels clear, simple, and supported.

Frequently Asked Questions

Question 1: What types of loans does LodgePro offer?

We provide home loans and investment loans for Australians seeking $10,000 or more.

Question 2: Who is eligible to apply for a LodgePro loan?

Australian Citizens and Permanent Residents who meet our responsible lending criteria can apply. Contact us to check eligibility.

Question 3: What is the minimum loan amount I can apply for?

All LodgePro supported loans start from $10,000 or more.

Question 4: Do you offer short-term or payday loans?

No. LodgePro does not support short-term or payday lending. All loans must be suitable, sustainable, and responsible

Question 5: What income requirements do I need to meet?

You must be in regular gainful employment.

Pensioners may apply, but must also show an additional business or employment income.

Question 6: Can I apply if I’m currently experiencing financial hardship?

Unfortunately, no. We can only support applicants who are not in financial distress, to ensure the loan does not worsen their situation.

Question 7: How long does the application and approval process take?

Most applications take only a few minutes online, and approvals can follow quickly depending on your lender’s requirements.

Question 8: What documents will I need to provide?

Common documents include ID, proof of income, bank statements, and details about your loan purpose.

Question 9: Will applying affect my credit score?

A preliminary assessment won’t impact your score. A formal application may involve a credit check depending on the lender.

Question 10: What fees or charges should I expect?

All fees and interest rates are shown upfront with complete transparency - no hidden surprises.

Question 11: Can I repay my loan early?

Most lenders we work with allow early repayments, though terms vary. We’ll help you understand any conditions beforehand.

Question 12: What support does LodgePro provide throughout the process?

From enquiry to approval, our lending specialists help you understand your options, prepare your documents, and navigate every step confidently and stress-free.

Lodgepro powered by Growth Prof, All Rights Reserved.

FOLLOW US

© 2025 Lodge Pro Tax Portal. All Rights Reserved.